How To Use Leverage Crypto & Make Big Money

Introduction

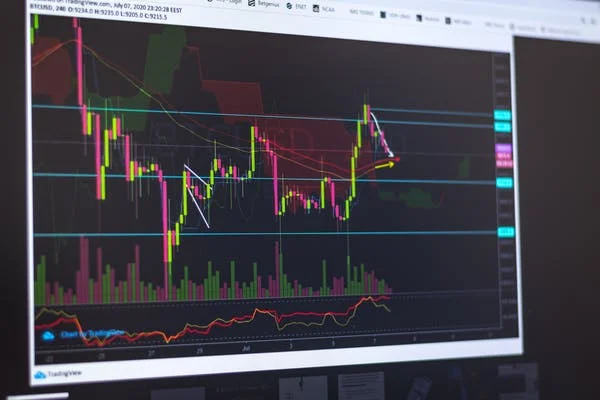

Leverage Crypto is a new trading strategy that allows you to make more profits by trading with leverage. This strategy involves using borrowed money to increase your position size. leverage crypto can help you make bigger profits when the market is moving in your favor, but it can also lead to losses if the market moves against you. Before you start using leverage, be sure to understand the risks involved

How Leverage Crypto Works?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Today, there are more than 1,300 different cryptocurrencies available.

Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services online. Like traditional currencies, cryptocurrencies are subject to inflation and deflation. Inflation occurs when the supply of a cryptocurrency increases faster than the demand for it, resulting in its value decreasing over time. Deflation occurs when the supply of a cryptocurrency decreases, resulting in its value increasing over time. Visit

https://www.btcc.com/ to know ups and downs of leverage trading.

Like other investments, investing in cryptocurrencies carries risks. Before investing in any digital asset, consult a financial advisor.

Benefits of Leverage Crypto

Leverage crypto can provide benefits in a number of areas, including:

-Reduced Risk: When trading with leverage, traders are not putting all their eggs in one basket. In the event that the price of a given cryptocurrency falls, the amount of loss incurred will be limited by the amount of leverage used. Conversely, if the price of a cryptocurrency increases significantly, losses may also be limited due to the leverage. This helps to reduce overall risk and help secure profitable trades.

-Potential for Profitable Trades: When using leverage crypto, traders can increase their potential return on investment (ROI) by trading larger amounts of cryptocurrency. By leveraging their funds, they can trade more confidently and ensure greater returns even if the market conditions are volatile.

-Faster Time to riches: It can take months or even years for some cryptocurrencies to become successful. With leverage, however, traders can achieve rapid gains in a shorter period of time. This allows them to capitalize on rapidly rising prices while avoiding major losses in case the market takes a downturn.

Wrapping Up

Leverage crypto is a Strategy that involves using borrowed money to increase the potential return on investment. In other words, you borrow money from a broker and use that money to purchase an asset, with the hope of being able to sell the asset at a higher price than you paid for it. The key to leveraging crypto successfully is finding an appropriate asset to invest in, and doing your homework so that you don’t end up losing your entire investment. Thanks for reading!